With a strong rental market in the city, Manchester has long been considered one of the best areas for property investment in the UK. The city boasts a wide range of tenants such as residents and students who are looking for high quality accommodation that suits a spectrum of needs from transport to lifestyle.

Manchester acts as the largest regional economy outside of London while also boasting a growth that is double that of London since 2014. This is, in part, due to the excellent levels of redevelopment and enterprise that has returned the city with more expected to come. These developments in the city’s economy provide exciting opportunities for investors who can expect impressive yields on their investments.

In this guide we’ll explore the state of property investment in Manchester including aspects such as the property market, the best buy to let areas of the city, amenities and transport links, and more!

Over the last couple of years, more and more people have begun to leave the country’s capital of London and relocating north to other cities such as Manchester and Birmingham, with the reason being mainly down to house prices and overall affordability of living. As this puts strain on the market as a whole as supply tries to meet demand, this creates an excellent opportunity for investors.

Manchester is growing into a hub for the digital and technology sectors, quickly becoming a leader in European markets. This creates further demand for property in the city from young professionals building careers in these cities as almost 70% of the employment in the city centre is made up of those working in the knowledge-intensive industries.

Homes needed pa over the next 10 years: 2500

Average supply pa over last 10 years: 1150

Population aged 15-34: 40%

Salary to house price ratio: 7.0

Employment Growth(next 5 years):1.3%

Population Growth(next 5 years): 1.1%

With an influx of new residents choosing to live and work in Manchester, the demand for suitable accommodation has naturally increased. With the average rental yield in Manchester (6.59%) being significantly higher than the UK average (3.63%) it is clear to see why investors love the city of Manchester.

Aside from the influx of new investors and people there are other factors that have helped to continually improve Manchester’s property market such as employment which has forecasted growth of 1.3% over the next five years.

The sting of increased stamp duty charges in 2016 saw buy-to-let investors take a step back from the market, however the demand for buy-to-let property is as strong as ever due to low property prices and attractive yields.

If you’re interested in specific postcodes that will give you the highest chance of providing profitable yields, M14 has become a popular location with an average yield of 7.07%. This data favour’s particular locations that are home to a high number of students and as Manchester occupies over 90,000 students across its 4 universities, it’s easy to see why investors can’t get enough of Manchester.

Here are the average rental yields of some of the more popular postcodes within the city:

| Postcode | (%) Average Rental Yield |

|---|---|

| M1 (City Centre) | 5.4 |

| M3 (City Centre) | 5.4 |

| M4 (City Centre) | 4.8 |

| M5 (City Centre) | 5.9 |

| M50 (Salford Quays) | 6.2 |

Data according to propertydata.co.uk

A recent report from Jones Lang LeSalle (JLL) showed that the average rental for a one bedroom apartment in Manchester city centre is now £1,225.00 per month, a growth of 25% over the previous twelve months. For the same period, a two-bedroom apartment would cost £1,600.00 (14% annual increase), with a three bedroom apartment now costing in excess of £2,200.00 per month, an increase of 33% year-on-year.

These large increases in rental costs for apartments in Manchester city centre is primarily driven by increased demand from both young professionals and students, but there is growing evidence to suggest that more families are now looking to remain in the city centre for a longer period before moving further out.

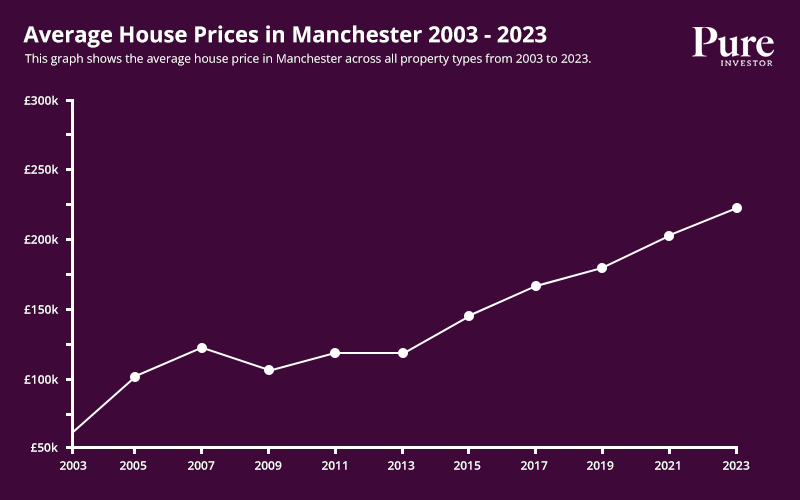

Figures from the Land Registry show that the average property price in Manchester continues to grow at a steady rate. Below is a table showing the average prices of each property type over the last 6 years:

| Postcode | 2023 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £238,522 (118) | £140,000 (1) | £0 | £300,000 (1) |

| M3 (City Centre) | £207,590 (179) | £0 | £261,500 (5) | £308,154 (13) |

| M5 (City Centre) | £167,813 (118) | £215,000 (1) | £228,751 (17) | £197,549 (44) |

| M8 (City Centre) | £110,651 (37) | £333,450 (5) | £228,304 (49) | £177,353 (65) |

| M9 (City Centre) | £94,688 (36) | £290,727 (22) | £189,781 (117) | £143,391 (166) |

| M50 (Salford Quays) | £201,240 (132) | £530,000 (1) | £0 | £168,333 (3) |

| Postcode | 2022 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £261,194 (387) | £0 | £0 | £489,961 (5) |

| M3 (City Centre) | £266,719 (820) | £360,000 (2) | £226,667 (6) | £423,295 (22) |

| M5 (City Centre) | £185,789 (371) | £0 | £204,850 (29) | £202,951 (68) |

| M8 (City Centre) | £100,573 (62) | £293,667 (9) | £231,910 (100) | £185,822 (90) |

| M9 (City Centre) | £91,854 (61) | £275,022 (34) | £186,858 (171) | £142,792 (249) |

| M50 (Salford Quays) | £197,270 (159) | £0 | £305,000 (3) | £360,000 (2) |

| Postcode | 2021 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £263,883 (257) | £270,000 (1) | £0 | £317,250 (2) |

| M3 (City Centre) | £234,329 (400) | £0 | £178,750 (6) | £258,411 (17) |

| M5 (City Centre) | £198,271 (399) | £277,000 (1) | £215,286 (21) | £188,965 (42) |

| M8 (City Centre) | £101,137 (34) | £322,150 (10) | £209,448 (55) | £150,516 (68) |

| M9 (City Centre) | £94,339 (28) | £246,820 (39) | £178,469 (151) | £146,548 (125) |

| M50 (Salford Quays) | £205,365 (60) | £420,000 (1) | £0 | £341,777 (9) |

| Postcode | 2020 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £226,045 (99) | £0 | £0 | £340,000 (1) |

| M3 (City Centre) | £250,936 (88) | £1,278,750 (1) | £175,500 (3) | £309,285 (7) |

| M5 (City Centre) | £155,747 (66) | £163,500 (1) | £185,071 (7) | £179,673 (26) |

| M8 (City Centre) | £86,485 (17) | £213,875 (8) | £187,358 (34) | £127,351 (41) |

| M9 (City Centre) | £85,538 (9) | £205,111 (9) | £147,349 (30) | £99,153 (52) |

| M50 (Salford Quays) | £201,229 (65) | £240,000 (1) | £378,400 (3) | £308,000 (2) |

| Postcode | 2019 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £215,228 (214) | £0 | £0 | £312,875 (4) |

| M3 (City Centre) | £321,000 (4) | £0 | £0 | £2,388,000 (2) |

| M5 (City Centre) | £223,374 (586) | £131,000 (1) | £153,857 (7) | £287,641 (11) |

| M8 (City Centre) | £226,409 (649) | £1,250,000 (1) | £203,500 (3) | £302,739 (14) |

| M9 (City Centre) | £173,103 (934) | £303,748 (2) | £172,659 (43) | £159,891 (72) |

| M50 (Salford Quays) | £0 | £177,863 (582) | £0 | £296,571 (7) |

| Postcode | 2018 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £205,372 (443) | £0 | £0 | £194,450 (2) |

| M3 (City Centre) | £224,950 (1) | £0 | £0 | £0 |

| M5 (City Centre) | £209,406 (418) | £292,000 (1) | £164,861 (9) | £318,509 (77) |

| M8 (City Centre) | £205,297 (484) | £0 | £195,998 (3) | £279,483 (26) |

| M9 (City Centre) | £177,531 (539) | £179,250 (4) | £164,333 (29) | £157,575 (79) |

| M50 (Salford Quays) | £182,014 (285) | £0 | £375,000 (2) | £252,692 (6) |

| Postcode | 2017 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| M1 (City Centre) | £196,288 (463) | £248,000 (1) | £0 | £233,662 (3) |

| M3 (City Centre) | £268,333 (3) | £0 | £0 | £0 |

| M5 (City Centre) | £219,107 (857) | £0 | £162,463 (8) | £280,080 (64) |

| M8 (City Centre) | £194,710 (478) | £172,500 (1) | £170,750 (3) | £331,715 (23) |

| M9 (City Centre) | £162,437 (49) | £247,633 (3) | £148,827 (38) | £150,184 (149) |

| M50 (Salford Quays) | £166,558 (765) | £297,167 (3) | £0 | £199,480 (7) |

Number in brackets is the total number of sales.

Data provided by Gov UK Land Registry.

Manchester is home to around 104,000 students, studying across the 4 Greater Manchester universities. Manchester has also earned itself the title of having the highest percentage of international students, boasting over 180 nationalities. There are also over 350,000 students across the 22 surrounding universities that are within an hour’s drive from Manchester.

It’s clear to see that Manchester has become a focal point among students both from the UK and overseas and the demand for suitable accommodation continues to grow every year. With generous returns and high spec student property investments in Manchester, investors have a wide range of options when it comes to investing in Manchester.

Average rents exceeding £1000 p/m

Average house prices of £245,000 over the last year

Property prices expected to grow by 2.5% YOY

If you’re an investor who wants to be a part of the hustle and bustle in Manchester City Centre, there are various avenues investors can go down to find a suitable property investment that can offer great returns.

In regards to residential property, Manchester City Centre sells a high number of flats compared to semi-detached or terrace properties and in the last 12 months, 307 flats were sold at an average value of £233,918 (Zoopla).

Average house prices of £242,488 over the last year

Large demographic of young professionals and families

Close proximity to the city centre.

Based on the city’s south-west side, Castlefield has developed a reputation as a hub for property investment. Many period buildings have been given a new lease of life and have been transformed into modern living spaces or offices to cater to the demand of new residents and businesses entering the area.

As Castlefield is right on the doorstep to Manchester City Centre, it’s a fantastic area for those who may want to live outside the city but commute into the centre for work, or vice versa. The surrounding transport links make this incredibly easy, whether that’s by car or train.

Average rents in excess of £1200 p/m

Average property price of £285,262 over the last year across all property types.

Excellent proximity to the Northern Quarter and the City Centre.

It comes as no surprise that Ancoats has been granted the title as one of the best places to live in the UK in 2019, by The Times and although regeneration projects have sprung Ancoats back to life it hasn’t replaced the rich history that makes Ancoats a great place to be.

The Northern Quarter may look deceivingly rundown on the outside but it’s actually a hidden treasure trove of modern apartments, some of which are the most sought after in Manchester.

Flats in Ancoats received the most sales in the past 12 months, with an average value of £271,617 (RightMove). RightMove reports that average sold prices in Ancoats over the past year had risen 4% compared to the previous year, which indicates that the Ancoats property market is only growing stronger year on year.

H3 - Green Quarter

Flats in the area can sell in excess of £200,000

Popular area for the young professional and family demographics

Close proximity to hotspots such as the City Centre and Northern Quarter

The Green Quarter is slightly different to its surrounding areas, as its more of a residential development than a district; however that doesn’t take away the fact that The Green Quarter is loved for its many independent food and drink businesses that bring the culture of Manchester to life.

Rental prices in The Green Quarter come in at around £700 per month for a 1-bedroom apartment, whilst 2-bedroom apartments start at £825 per month. The amenities and all-round excellent location of The Green Quarter support the fact that even though there is less choice when it comes to property, the demand is still there for investors to take advantage of.

Average property price of £201,373 over the last year

Property price growth of 3% over the peak in 2021

Average rental yields of 5 to 7%

Far removed from the urban decay seen throughout Salford Quays in the 1970's and 80's, Salford Quays is now a thriving commercial and residential district, which is home to some of the UK's leading corporations including the BBC and ITV.

Understandably, such a large increase in employment throughout the area placed a significant demand on the local property market, and today both short and long term rental accommodation in Salford Quays is in high demand, creating exciting opportunities for property investment in Manchester.

Whilst a number of high profile residential developments were launched in the Salford Quays district in the past two years, the demand for buy-to-let property in Salford Quays is today at an all time high, with investors both in the UK and overseas keen to capitalise on the increasing demand for rental accommodation.

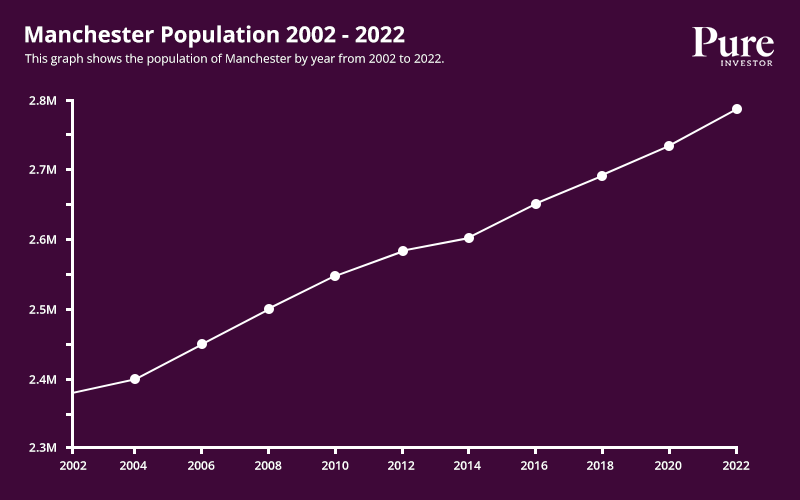

The Manchester population increased by over 20,000 between 2020 and 2021, with the total population set to increase to 2.87m by 2025 and over 70,000 jobs are forecast to be created due to the development of professional services and regeneration projects.

So, what’s next for the Manchester property market? Many believe that the property market within the North West of England is set to boom in the next few years.

Predictions of increased wages, interest rates and property transactions are set to transform Manchester’s property market not only for existing investors but those looking to take their first steps on the property ladder.

With evidence to suggest the average age of property investors is falling, the next generation of property investors are in a great position to be a part of the transformation of Manchester’s property market for years to come.

As regeneration projects in Manchester continue into their first or next phases, predictions for the growth in population are estimated to increase by around 14% over the next 20 years. The growth in population will also include the amount of students that choose to study in Manchester. With one of the highest graduation retention rates, it’s no surprise students continue to flock to universities across Manchester.

The combination of increased number of students and the cities regeneration projects will naturally increase demand for rental properties, with many students choosing to continue life within Manchester after they have graduated. Many students will therefore start their journey as a first time buyer and wish to look for better housing in areas that are closer to work and transport links.

In regards to house prices, if we look at a 5-year forecast, Manchester house prices are predicted to rise 17.1% in total despite the impacts of the COVID-19 Pandemic.

Manchester has long been a growing property market in the UK and has attracted investors both domestically and from overseas. Not only this, but with the property market expected to continue its growth while other markets are seemingly in a stagnant and even declining period shows the strength of the demand in the Manchester area.

In addition to the continued strength of the residential investment market, student property in Manchester continues to be a reliable investment for many. With more than 100,000 students residing in the city every year there is a constant demand for student accommodation throughout Manchester.

Not only this, but with the increase in industry investment and more businesses beginning to choose Manchester as their home, now is also a great time for those who wish to expand their commercial property portfolio.

Key to the success and growth of Pure Investor in recent years has been our location on the outskirts of Manchester. Strategically located to offer all our consultants easy access to Manchester, Liverpool, Sheffield and Leeds, we are regular visitors to all the major property developments within the key Northern Powerhouse destinations.

We are passionate about the growth and development within these locations, ensuring our consultants have a high level of expertise regarding the development opportunities within these key growth areas. For this reason, many investors choose to speak with Pure Investor first when considering property investment in the North England.

We genuinely believe in working with our clients, providing a high quality of service and information, allowing our clients to make their decision on a more informed basis. As a result of this, an increasing number of investors are choosing to return and utilise our services on an ongoing basis. This is something we are incredibly proud of, and which we are looking to continually improve on in the future.

If you are considering in investing in a property in the North of England, and don't fancy the 'hard sell' approach, please feel free to get in touch on either enquiries@pureinvestor.co.uk or call us on 0161 337 3890.

We look forward to hearing from you!

Call us on +44 (0) 161 337 3890 or contact us using the form below to arrange your free no obligation property consultation.

Our glossary of terms contains a comprehensive guide to various property investment related terms to give you a better understanding of the language and terminology used when talking about investing in property.

Find out MoreAre you looking to sell your investment property? The team at Pure Investor can help you sell your investment property and can handle the process from start to finish.

Find out MoreCall our team today on +44 (0) 161 337 3890