Buy-to-Let property in the UK offers excellent yields with a good capital growth potential and it looks as though the trend is going to continue into the near future.

Property of the month

Bankside at Colliers Yard

Manchester, United Kingdom

Invest from only:

£305,000.00

Buy-to-Let property in the UK offers excellent yields with a good capital growth potential and it looks as though the trend is going to continue into the near future.

Buy-to-let properties are becoming the chosen investment for many as they seek to find an asset where their money can work hard for them, providing high returns as well as offering a safe investment. The price of property in recent years has continued to increase in many areas of the UK and the same can be said for rental prices which make a buy-to-let investment even more appealing.

Historically, purchasing property has been one of the safest ways to invest but it has also been one of the best performing investments and this still remains the same. A UK buy-to-let property investment brings together the benefits of a regular income along with capital appreciation in the long-term.

For those investors looking to make a buy-to-let property investment now is a great time to begin the process. Rental prices are increasing and yields of up to 10% can be achieved and in some cases more, especially if the right property is purchased.

When compared to the extremely low interest on savings it is easy to understand why investing buy-to-let properties is a popular choice with investors, but they are also driven by the potential capital growth in the medium to long-term.

If you're interested in learning more about buy-to-let investments, continue below to read our comprehensive Buy-to-Let Property Investment Guide which will provide you with information on how to plan, research and begin your first (or next) buy-to-let investment.

For more information on our buy-to-let property investment service or if you need assistance in making the right investment decision, contact Pure Investor today.

Call us on +44 (0) 161 337 3890 or contact us using the form below to arrange your free no obligation property consultation.

Are you considering selling your property with sitting tenants?

Concerned about losing rental income, or paying expensive utility bills for 4-5 months whilst you sell? We specialise in selling properties with tenants in situ, often saving the landlord thousands of pounds in lost rental income.

With any buy-to-let property investment, there will be many questions and areas of the investment that require much consideration. With so many factors to consider, from tax to tenants to finance, it’s enough to leave you wondering if a buy-to-let investment is the right choice to make. To ensure you’re not leaving any money on the table, our buy-to-let property investment guide will help you to plan, research and begin your first (or next) buy-to-let investment.

A buy-to-let property is purchased for the single reason to be rented out to tenants, rather than lived in yourself. For years this has been a tried and tested way for investors to generate revenue through charging more rent than the monthly mortgage repayments, before making capital gains when selling in the future.

Like all investments, however, buy-to-let does carry some risk. Rising interest rates may make mortgage repayments higher than the rent you charge. You may be stuck with difficult tenants who are unable to pay rent. Or when you decide to sell your property, there may not be a buyer. Doing your homework before you invest is vital.

When starting out it’s easy to get carried away thinking about the projected profit, however before you begin your property investment, it’s best to know exactly what area of property investment you’re going to focus on.

Ideally, you should focus on either rental returns or capital growth. If you’re lucky you might get a bit of both, though you’ll likely find other investors are making better returns than you are by only going for one or the other.

There’s no right or wrong answer to which is best for your situation, it comes down to which is the most financially viable. The location you’re looking for, your budget, your income from other sources all contribute to making this decision.

When choosing the right property for your buy to let investment, you must consider a number of different variables. Each one can have an effect on how much rent you can charge, your income from the property, as well as the rate at which your property’s value will appreciate over time.

Some of the main aspects that you should think about are:

When it comes to choosing the location of your buy-to-let property investment, you should ask yourself ‘Is there a demand for rental properties in the area?’ This is essential to becoming a successful buy-to-let investor, and having the ability to spot an over-saturated rental market, as this will mean tough competition with no real possibility of rental increases, therefore making it difficult to make the investment work in the right way.

When considering the aesthetics of your property, you’ll want to plan and research the style and type of property, as well as the overall state of the property which depending on its condition may require time and money. This is why research into your property and your role as a buy-to-let landlord is crucial.

Also having an understanding of the potential net rental yields in that area will help to narrow down your search. Your buy-to-let property investment doesn’t have to be on your door step, but be aware if you choose a location that is further afield, be sure to take into consideration travel time and costs for dealing with your property and its tenants.

Ask yourself, is your investment financially viable? From your finances to the tenants you ideally want all the way through to your exit strategy, your early research makes your potential profits more likely and as predictable as possible.

Here are some of the financial questions that can help shape your research:

Once you’ve completed your financial research you should start looking at your ideal tenant.

Knowing your ideal tenant makes finding the right investment property so much easier. A lot of the most successful property investors specialise in a single type of investment, for example student, residential buy-to-let, or even a specific location, such as Manchester, Liverpool, Leeds or Birmingham. Focusing on a single type of investment or location can help decide who your ideal tenant is.

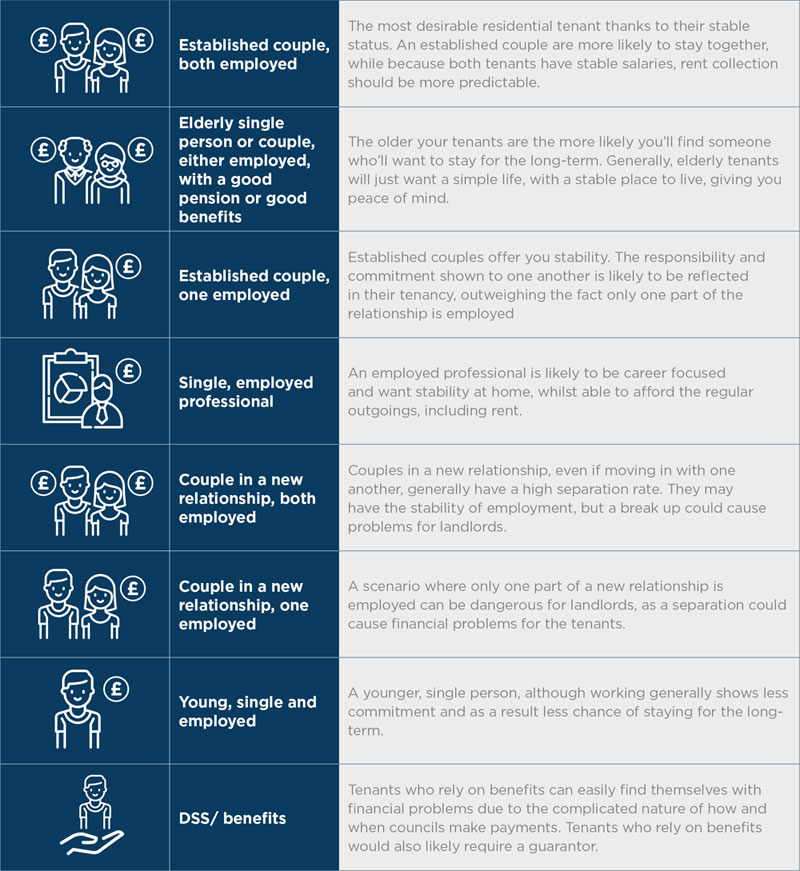

The below table shows the different types of residential tenants and benchmarks their stability for the likelihood of being in your property for the long-term:

Aside from how the property looks, getting a feel for the location is important to understand what is going to appeal to your tenant which will only strengthen your position. Good transport links and local amenities all help to make certain properties stand out from the rest, so ensuring that the property is likely to match the preferences of any potential tenants will enable investors to really maximise its potential.

Tenants now expect more from their rental accommodation so additional costs such as fitting modern bathrooms and luxurious kitchens have to be taken into consideration but remember that it is likely to help return higher yields when it comes to rental prices and capital appreciation.

Any buy-to-let investment comes with responsibilities. You’ll have a legal responsibility to your tenant, making sure the deposit is safe and rights to live in your property are protected by an Assured Shorthold Tenancy (AST).

An AST gives tenants a legal right to live in your property for a fixed period of time, usually six or 12 months, or offers a flexible rolling term.

An AST outlines:

Protecting a tenant's deposit is another responsibility. Deposit protection schemes are a legal requirement that will result in you or your letting agent being fined if you don’t supply one.

There are two types of government-backed deposit protection schemes:

Each scheme comes with an independent resolution service if any disagreements arise at the end of the tenancy.

Other landlord responsibilities include:

Like all investments there’s always the possibility of risk. There’s time, financial and legal commitments that need to be tightly managed. If you’re not in a position to give your resources to all three areas, property investment is unlikely to be right for you.

Some of the pitfalls you will want to consider are:

Low base rates and falling bank rates make mortgages much more affordable. Once bank rates start to increase though, mortgage payments will rise also. Even a small increase will make mortgages less affordable.

Risking your capital too much can lead to higher costs eating into your yields (at best) or repossession (at worst).

If you feel you’re stretching yourself too much it’ll be wise to re-evaluate your investment strategy and either look at lower price alternatives or spend more time building up your capital.

Rising interest rates do give you opportunities though. Mortgage payments increase on residential mortgages as well as buy-to-let. A lot of home owners, or potential home owners, will be put off buying properties and will instead choose to rent.

Stretching yourself too much will put you in difficult positions if your property is in need of repair or goes through a period of being vacant (it will happen at some point).

You might be lucky. If you’ve chosen a good location and an in-demand property, you could find yourself with a new tenant in just a few days. If not, you could find yourself spending time putting things right or repairing damages after a tenant leaves, costing you time and eating into your profits, not to mention the fact that you’re not receiving any rent.

Here are some things you should do when you find yourself with a vacant property:

A string of new taxes for investors in UK property has left a lot of people confused and seeking advice on how to protect assets and income.

Here’s an overview of the major tax implications* that you should be aware of:

The rental returns you receive will be taxed in line with your relevant tax band.

Some costs will be tax deductible, including:

Since April 2016 you can no longer claim 10% “wear and tear” costs on furnished properties against your tax bill, instead only claiming for actual damage or repair.

More recent legislation will cap the relief on mortgage interest for all landlords at the basic rate of 20%. Investors were previously able to claim mortgage relief of up to 45%. The reduction was introduced in April 2017, to be fully complete by 2020.

When it comes to selling your property, you are not exempt from capital gains tax. Any profit you make on the capital value of your property investment will be liable to either 18% or 28% tax depending upon your tax bracket.

Current legislation gives you the first £11,100 profit free of capital gains tax, going up to £22,200 for couples with joint assets, stamp duty can also be offset against capital gains tax. However, you will have to pay any capital gains tax within a month of a sale completing.

Since 1st April 2016 landlords have been hit by an extra 3% tax for any properties owned in addition to the main residence. This applies to:

Assuming an investor is based in the UK, there is a standard deduction (taken at source) of 20% tax from the UK tax authorities (HMRC) on the rental income.

However, for Non UK Resident Investors, an exception can be applied for through HMRC, which is called The Non Resident Landlord Scheme (NRLS). Obtaining NRLS status enables you to receive the rental income without tax being taken at source.

However, this does not mean that you are not liable to UK income tax and just as important, it does not mean that you do not have to file an annual UK tax return, you do. If you require further information on this subject, we can introduce you to experienced tax specialists. Part of our service would be to assist you through the whole process.

*Please note we’re not tax advisors. This is simply an overview of the UK tax market only. You should still speak with a property tax professional before making any investment.

Congratulations!

You’ve purchased your buy-to-let property. Once the sale has gone through you’ll want to start recouping some of your investment in rent. It’s now time to decide how hands-on you want to be. Should you use an agent, and in which case how do you choose one?

Here are some of the pros and cons you should consider when making this decision:

Being hands-on with your investment can save you between 8% to 10% of rental income by avoiding management fees. You can also personally vet your prospective tenants, allowing you to have more control of the issues faced by your tenants. You may also find it easier to use your own suppliers and have more flexibility to carry out viewings outside of working hours.

Despite giving you more control over your investment, with a hands-on approach with your buy to let property you can expect to spend a lot of time carrying out viewings when your property is vacant.

You will also be responsible for carrying out credit checks, the legal paperwork and protecting deposits as well as being responsible for any rental negotiations.

There are also many advantages of taking a hands-off approach with an buy to let property. For example, any agent that you use, or is already in place if you’re investing in a new build development, will oversee all viewings, legal paperwork and, in most cases, protect the tenancy deposit. Using agents will free up your time, with less pressure on you to carry out viewings during evenings and weekends.

With a hands-off investment, you place a lot of faith in a management agency, so making sure you choose the right partner is vital. An agency is likely to charge additional fees for any service not specified in the standard management contract, including administration and arrangement fees for using a network of preferred suppliers. Additionally, an agency will not have the same motivations to get your property rented as you will, which may leave you with a vacant property for longer.

Exit strategies are the most avoided, and for a lot of investors, the most confusing part of property investment. Simply put, your exit strategy is your way of making the big profits, so how do you get the big profits from your property portfolio?

You could have any number of reasons to want to exit. You could be turning your attention towards retirement. You could be restructuring your portfolio. Or you could be looking to free up some of your capital to invest elsewhere.

Your exit strategy will depend upon your personal situation and the tax consequences that come with your decision. Here are some of the most common property investment exit strategies:

There’s a common view that you can’t get mortgages once you pass 60 years old. This is true for residential mortgages, it’s unlikely you’ll work long enough to pay your mortgage off each month.

For buy-to-let mortgages however, you can get loans that can be repaid until you are more than 100 years old. This could make inheritance tax more complicated, leaving your heirs scrambling around to refinance or sell your remaining properties. However, there are options to protect your investment.

One way to protect your property portfolio is to transfer ownership, or purchase your property, through a limited liability company. If there is another director with enough income to personally guarantee any outstanding finance ownership will stay within the business.

There is of course risk. If your circumstances change once you’re retired you could be relying on interest rates to keep your income favourable.

One popular exit strategy is to sell some of your property portfolio to pay off your outstanding mortgages on your others. This leaves your remaining portfolio with no outstanding finance.

In theory, this exit strategy leaves you with a bulletproof source of income. Rent and income both generally rise with inflation and your capital values become a secondary thought. Your main income becomes rent received. And unless your circumstances change, you’ll keep hold of your remaining properties.

You’ll have capital gains tax to consider once you start selling your properties, however phasing your sales over several years can reduce your tax bill and reduce your liabilities. The biggest risk with this strategy comes if you don’t have enough rental income from your remaining properties. If you have periods of no rent coming in your savings will have to keep you afloat.

You could decide to move away from being an active property investor completely. There are other more tax efficient choices, although if capital gains tax isn’t a worry then selling your property portfolio will give you the opportunity to free up your capital.

Moving away from your responsibilities as a Landlord can give you peace of mind that your finances are secure, without the worry of possible volatile interest rates.

This is the most popular exit strategy.A combination of the other options, restructuring your property portfolio gives you the opportunity to free up the capital in your property investments to diversify and restructure.

According to some, student buy-to-let investments are the best performing property investments.

Purpose-built student properties have become some of the most popular developments, with those in locations with high student populations in demand.

Here are the things you should know if you decide to let to students:

Renting to students isn’t all sunshine and roses though. You should be aware that, like all investments, student property carries risks. Students only need properties during term time, meaning your investment will likely be unused during summer breaks – something you’ll have to factor into your rental yield returns.

Also, traditional methods of credit-checking tenants may be difficult when dealing with students. Many students have a limited (if any) credit history and no regular income, however using a guarantor will reduce risk.

It’s also worth considering if you want a new build, off-plan or a renovation:

High property prices will likely result in a lower rental yield, so you’ll be reliant on a medium to long-term investment in capital growth for you to realise your profits.

A location with high property costs will focus on capital growth, a medium to long-term investment, whereas a property that costs less, or ideally undervalued, will return higher yields, but not so much in terms of capital growth.

The most profitable location may not be the one you’ve got your heart set on. Ultimately this is an investment.

Cast your net wider and look at towns with good commuting links. Then focus on whether you want your tenants to be families, single professionals or students. If you’re looking at students look for cities with popular universities, and ideally undersupplied areas for student property.

For more information on our buy-to-let property investment service or if you need assistance in making the right investment decision, contact Pure Investor today.

Whether you're a seasoned investor or considering your first property investment, our experienced team are here to help. Arrange a FREE call back from one of our team!

Call our team today on +44 (0) 161 337 3890