Published: 9th October 2017

Should you invest in student property?... Do you focus on rent or capital returns?... Where should you buy, in the UK or overseas?

Whether you’re looking at your first, or your next, buy-to-let investment, you’ll have so many questions going through your head.

With so many areas to consider, from tax to tenants to finance, it’s enough to give you a headache. Or at worst, put you off investing in property altogether.

To make sure you’re not leaving any money on the table I’d like to share with you what your top ten priorities should be, before you part with any of your well-earned finances.

Contents

• What is Buy-to-Let?

• Setting Your Goals

• Getting Tax Aware

• Choosing Your Location

• Your Landlord Responsibilities

• Researching Your Options

• Choosing Your Tenant

• Knowing the Pitfalls

• Shopping Around for a Mortgage

• Choosing How Hands-On You Want to be

• Focusing on Your Exit Strategy

Simply put, a buy-to-let investment is where a property is purchased for the single reason to be rented out to tenants, rather than lived in yourself.

For years this has been a tried and tested way for investors to generate revenues through charging more rent than the monthly mortgage repayments, before making capital gains when selling in the future.

Like all investments, however, buy-to-let does carry risk. Rising interest rates may make mortgage repayments higher than the rent you charge. You may be stuck with difficult tenants who are unable to pay rent. Or when you decide to sell your property, there may not be a buyer.

Doing your homework before you invest is so important.

Now let’s delve right in to the ten things you should be focusing on when you invest.

When starting out it’s common to get pound signs in your eyes.

You’re going to make a profit. You’re not sure how, but you know it’s going to happen. And do you know what, you possibly can.

But if you want to make big returns, it’s best to know exactly what area of property investment you’re going to focus on.

Ideally, you should focus on either rental returns or capital growth.

If you’re lucky you might get a bit of both, though you’ll likely find other investors are making better returns than you are by only going for one or the other.

There’s no right or wrong answer which is best for your situation, it comes down to which is the most financially viable for your situation. The location you’re looking for, your budget, your income from other sources all contribute to making this decision.

There’s no right or wrong answer which is best for your situation, it comes down to which is the most financially viable for your situation. The location you’re looking for, your budget, your income from other sources all contribute to making this decision.

For example, high property prices will likely result in a lower rental yield, so you’ll be reliant on a medium to long-term investment in capital growth for you to realise your profits.

On the other hand, an undervalued property is likely to give you better yields.

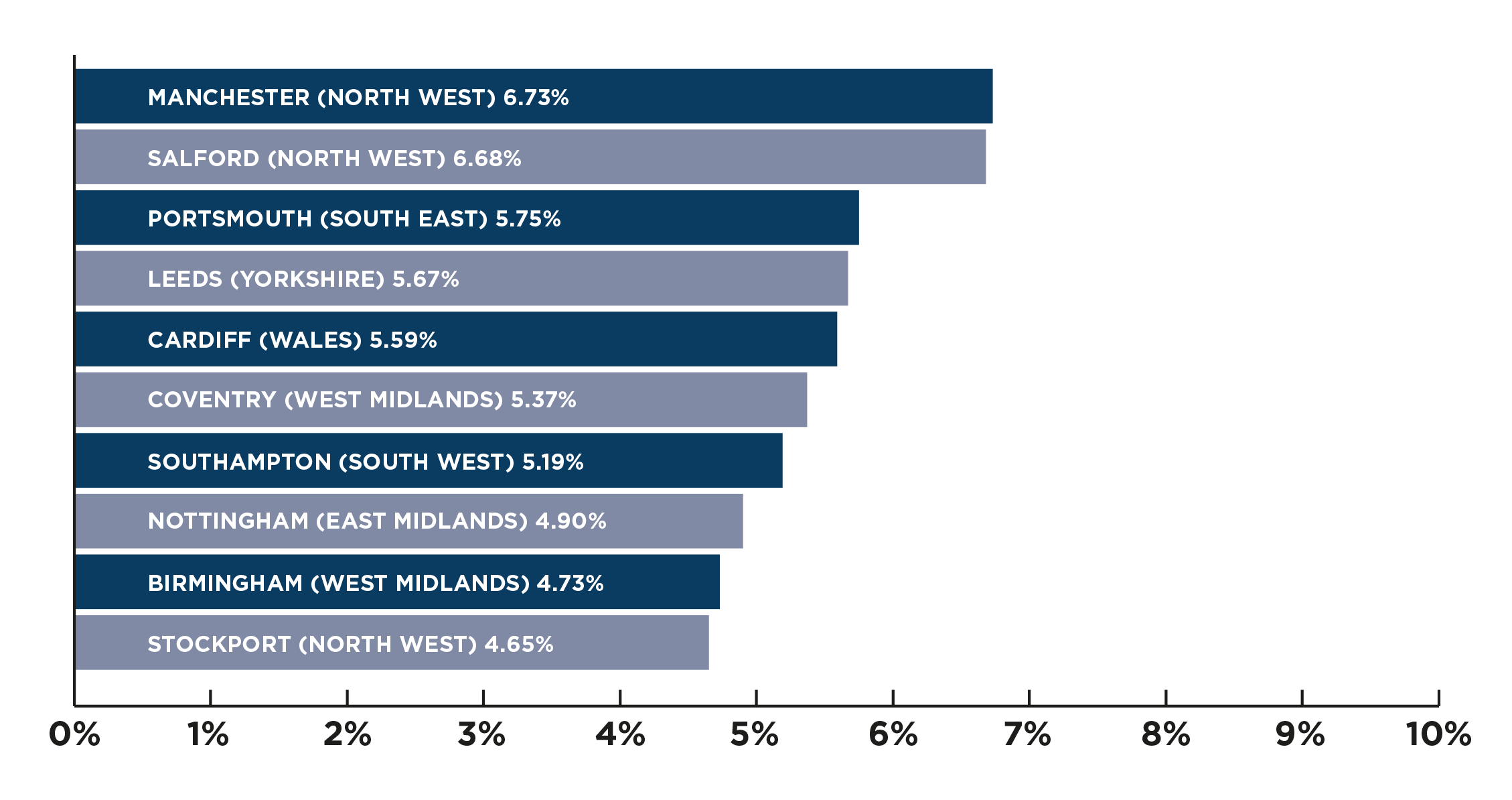

A good rental yield is valued at approximately 5% per year, whilst some off-plan investments offer assured rentals, some up to 8% per year. Or if you want to look at the HMOs route you can achieve rental yields of 12-15% per year.

A string of new taxes for investors in UK property has left a lot of people confused and seeking advice how to protect assets and income.

Here’s an overview of the major tax implications* that you should be aware of:

The rental returns you receive will be taxed in line with your relevant tax band.

Some costs will be tax deductible, including:

Since April 2016 you can no longer claim 10% “wear and tear” costs on furnished properties against your tax bill, instead only claiming for actual damage or repair.

More recent legislation will cap the relief on mortgage interest for all landlords at the basic rate of 20%. Investors were previously able to claim mortgage relief of up to 45%. The reduction was introduced in April 2017, to be fully complete by 2020.

When it comes to selling your property, you are not exempt from capital gains tax.

Since 1st April 2016 landlords have been hit by an extra 3% tax for any properties owned in addition to the main residence.

This applies to:

*Please note we’re not tax advisors. This is simply an overview of the UK tax market in 2017 only. You should still speak with a property tax professional before making any investment.

It might be a cliché, and I’m apologising upfront for this, but location, location, location is so important.

The location you choose will tie into your goals.

A location with high property costs will focus on capital growth, a medium to long-term investment, whereas a property that costs less, or ideally undervalued, will return higher yields, but not so much in terms of capital growth.

The most profitable location may not be the one you’ve got your heart set on.

You should consider questions like:

Ultimately this is an investment.

Cast your net wider and look at towns with good commuting links. Then focus on whether you want your tenants to be families, single professionals or students. If you’re looking at students look for cities with popular universities, and ideally undersupplied areas for student property.

It’s also worth considering if you want a new build, off-plan or a renovation:

Any buy-to-let investment comes with responsibilities.

You’ll have a legal responsibility to your tenant, making sure the deposit is safe and rights to live in your property are protected by an Assured Shorthold Tenancy (AST).

An AST gives tenants a legal right to live in your property for a fixed period of time, usually six or 12 months, or offers a flexible rolling term.

An AST outlines:

Protecting a tenant's deposit is another responsibility.

Deposit protection schemes are a legal requirement that will result in you or your letting agent being fined if you don’t supply one.

There are two types of government-backed deposit protection schemes:

Each scheme comes with an independent resolution service if any disagreements arise at the end of the tenancy.

Other landlord responsibilities include:

The million-dollar question (literally)… is your investment financially viable?

From your finances to the tenants you ideally want all the way through to your exit strategy, your early research makes your potential profits more likely and as predictable as possible.

Here are some of the financial questions that can help shape your research:

Once you’ve completed your financial research you should start looking at your ideal tenant:

The one thing that gets overlooked the most… how do you get the big profits from your property portfolio?

Here are just some of the ways you can plan to increase your profits:

Knowing your ideal tenant makes finding the right investment property so much easier.

A lot of the most successful property investors specialise in a single type of investment, for example student, overseas or residential buy-to-let, or even a specific location, such as London, Manchester or even Cape Verde.

By focusing on a single type of investment or location, you know straight away who your tenant is.

Below are a few ways to identify your ideal tenant:

According to some, student buy-to-let investments are the best performing property investments.

Purpose-built student properties have become some of the most popular developments, with those in locations with high student populations in demand.

Here are the things you should know if you decide to let to students:

Renting to students isn’t all sunshine and roses though. You should be aware that, like all investments, student property carries risks. Here are some of those:

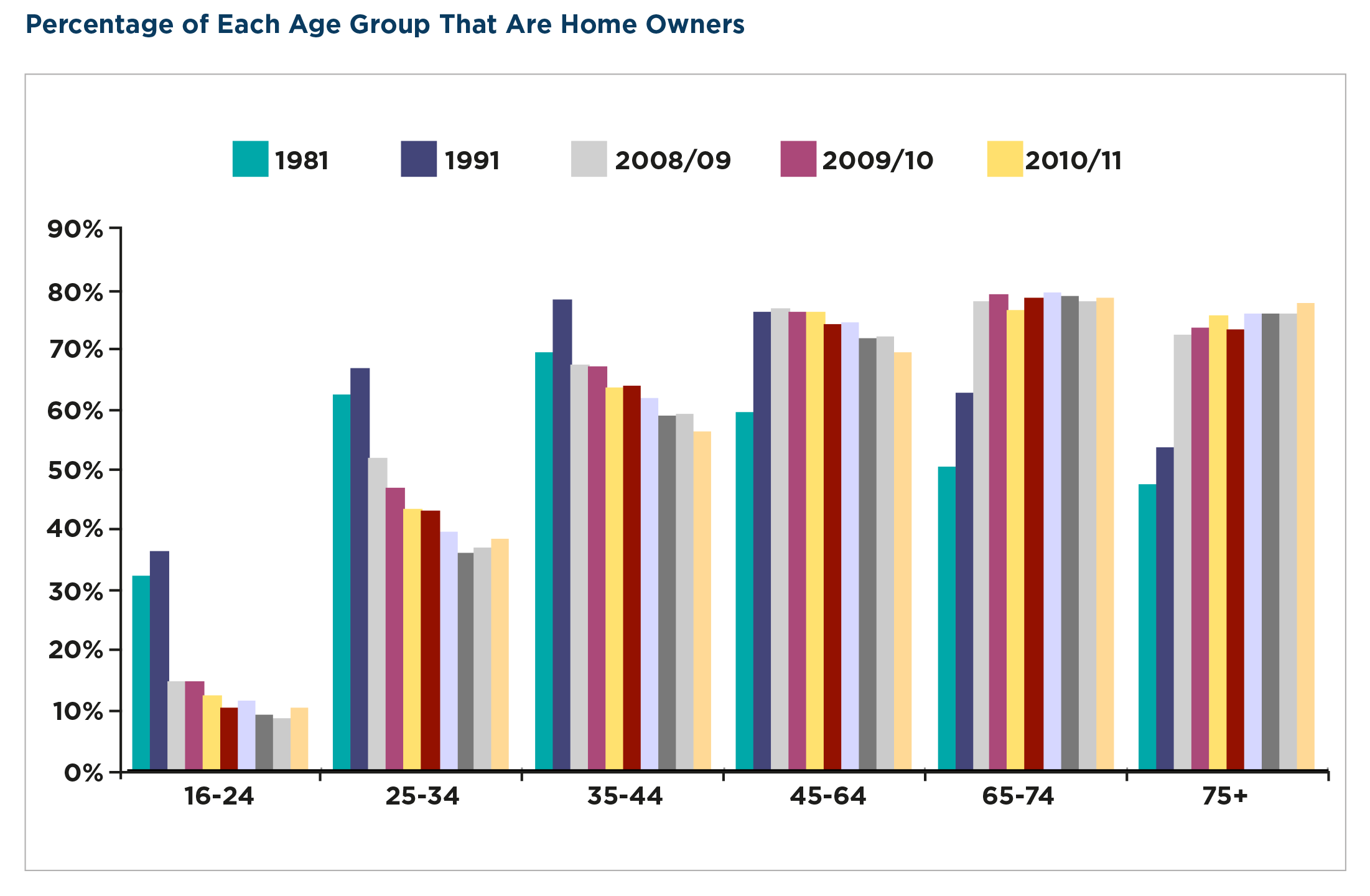

Residential buy-to-let investments are becoming more popular.

UK national statistics show more families are renting, with first-time buyers getting older. This trend creates an opportunity for property investors looking for an alternative to students.

*Source: Office of National Statistics

*Source: Office of National Statistics

The below table shows the different types of residential tenants and benchmarks their stability for the likelihood of being in your property for the long-term:

The right preparation will help you know the pitfalls of property investment.

Like all investments there’s always the possibility of risk. There’s time, financial and legal commitments that need to be tightly managed. If you’re not in a position to give your resources to all three areas, property investment is unlikely to be right for you.

I don’t want to be the bearer of bad news, but there are just as many property investment failures as there are successes. I just want to make sure you know exactly what to expect and what will be required from you to make your investment a good news story.

Some of the pitfalls you will want to consider are below:

Low base rates and falling bank rates make mortgages much more affordable. Once bank rates start to increase though, mortgage payments will rise also. Even a small increase will make mortgages less affordable.

Risking your capital too much can lead to higher costs eating into your yields (at best) or repossession (at worst).

If you feel you’re stretching yourself too much it’ll be wise to re-evaluate your investment strategy and either look at lower price alternatives or spend more time building up your capital.

Rising interest rates do give you opportunities though.

Mortgage payments increase on residential mortgages as well as buy-to-let. A lot of home owners, or potential home owners, will be put off buying properties and will instead choose to rent.

Stretching yourself too much will put you in difficult positions if your property is in need of repair or goes through a period of being vacant (it will happen at some point).

You might be lucky.

If you’ve chosen a good location and an in-demand property, you could find yourself with a new tenant in just a few days.

If not, you could find yourself spending time putting things right or repairing damages after a tenant leaves, costing you time and eating into your profits.

Not to mention the fact that you’re not receiving any rent.

Here are some things you should do when you find yourself with a vacant property:

Mortgages for investment properties are traditionally complicated.

You can easily find different mortgage providers offer you different terms, from the amount of deposit you’ll need all the way through to the type of investment you can get funding for.

And this doesn’t even touch upon the financial implications.

If you go straight to your bank or building society without shopping around you might find yourself paying a higher interest rate, paying high set-up fees or locked into an agreement that becomes difficult for you to change later.

Here are some things you should know about buy-to-let mortgages that you should look out for:

Buy-to-let mortgages make it easier to leverage the value of a property to maximise your returns.

But financing your investment using someone else’s money brings with it greater risk and additional costs. Here are some of them:

Expect fees starting from £1,500 for lawyers and mortgage lenders

Interest rates for buy-to-let investments are usually higher than residential mortgages

If you do get a low interest rate you might find yourself paying more for arrangement fees

Brokerage fees for arranging any purchase or sale of your investment property

You can expect a deposit contribution of between 20% and 40%, usually 25%

Each mortgage provider has their own criteria.

You might find one provider will happily give you a mortgage. Another, however, might be hesitant or even say no. The decision is simply down to the lender themselves.

Generally, you’ll find it easier to get a buy-to-let mortgage if you meet the below criteria:

It’s really worth using a buy-to-let mortgage comparison tool or speaking with an independent mortgage broker first.

Just like using a mortgage for your own home, buy-to-let mortgages offer different solutions depending on your situation.

You will find three major differences between the two types of mortgage though, which you can find below:

This depends on your situation and how much leverage you can apply.

The interest rate, size of deposit and arrangement fee will be different depending upon the provider. Below are some reasonable finances that you can expect:

Congratulations!

You’ve purchased your buy-to-let property.

Once the sale has gone through you’ll want to start recouping some of your investment in rent.

It’s now time to decide how hands-on you want to be.

Should you use an agent, and in which case how do you choose one?

Here are some of the pros and cons you should consider when making this decision:

Exit strategies are the most avoided, and for a lot of investors, the most confusing part of property investment.

Simply put, your exit strategy is your way of making the big profits.

You could have tonnes of reasons why you want to exit. You could be turning your attention towards retirement. You could be restructuring your portfolio. Or you could be looking to free up some of your capital to invest elsewhere.

Your exit strategy will depend upon your personal situation and the tax consequences that come with your decision.

Here are some of the most common property investment exit strategies:

There’s a common view that you can’t get mortgages once you pass 60 years old.

This is true for residential mortgages, it’s unlikely you’ll work long enough to pay your mortgage off each month.

For buy-to-let mortgages however, you can get loans that can be repaid until you are more than 100 years old.

This could make inheritance tax more complicated, leaving your heirs scrambling around to refinance or sell your remaining properties. However, there are options to protect your investment.

One way to protect your property portfolio is to transfer ownership, or purchase your property, through a limited liability company. If there is another director with enough income to personally guarantee any outstanding finance ownership will stay within the business.

There is of course risk. If your circumstances change once you’re retired you could be relying on interest rates to keep your income favourable.

One popular exit strategy is to sell some of your property portfolio to pay off your outstanding mortgages on your others. This leaves your remaining portfolio with no outstanding finance.

In theory, this exit strategy leaves you with a bulletproof source of income.

Rent and income both generally rise with inflation and your capital values become a secondary thought. Your main income becomes rent received. And unless your circumstances change, you’ll keep hold of your remaining properties.

You’ll have capital gains tax to consider once you start selling your properties, however phasing your sales over several years can reduce your tax bill and reduce your liabilities.

The biggest risk with this strategy comes if you don’t have enough rental income from your remaining properties. If you have periods of no rent coming in your savings will have to keep you afloat.

You could decide to move away from being an active property investor completely.

There are other more tax efficient choices, although if capital gains tax isn’t a worry then selling your property portfolio will give you the opportunity to free up your capital, move away from your responsibilities as a Landlord and give you peace of mind that your finances are secure, without the worry of possible volatile interest rates.

The most popular exit strategy.

A combination of the other options, restructuring your property portfolio gives you the opportunity to free up the capital in your property investments to diversify and restructure.

Here’s an example of how to restructure your portfolio:

Property investors used to focus on capital growth as a way of making big profits.

Now rental yields are what gives you the regular income.

As investors, your exit strategy revolves completely around your ability to stay emotionally neutral to your property. Bricks and mortar are an investment only.

If your property has stopped making you money, then your investment is no longer useful.

Only keep the properties that give you good yields, have potential for high capital growth and are easy to rent when you are faced with vacant periods.

Call our team today on +44 (0) 161 337 3890